Authored blogs

Year-End Tax Considerations for Vet Practices: Part 2

Planning your practice's taxes as much as three months before the end of the year can help you make choices that get the next year off to a strong start. Tax professional Regina Rennhack is back with part two of her series, sharing even more key tax planning principles for veterinary practices.

Not Too Early: Year-End Tax Considerations for Vet Practices

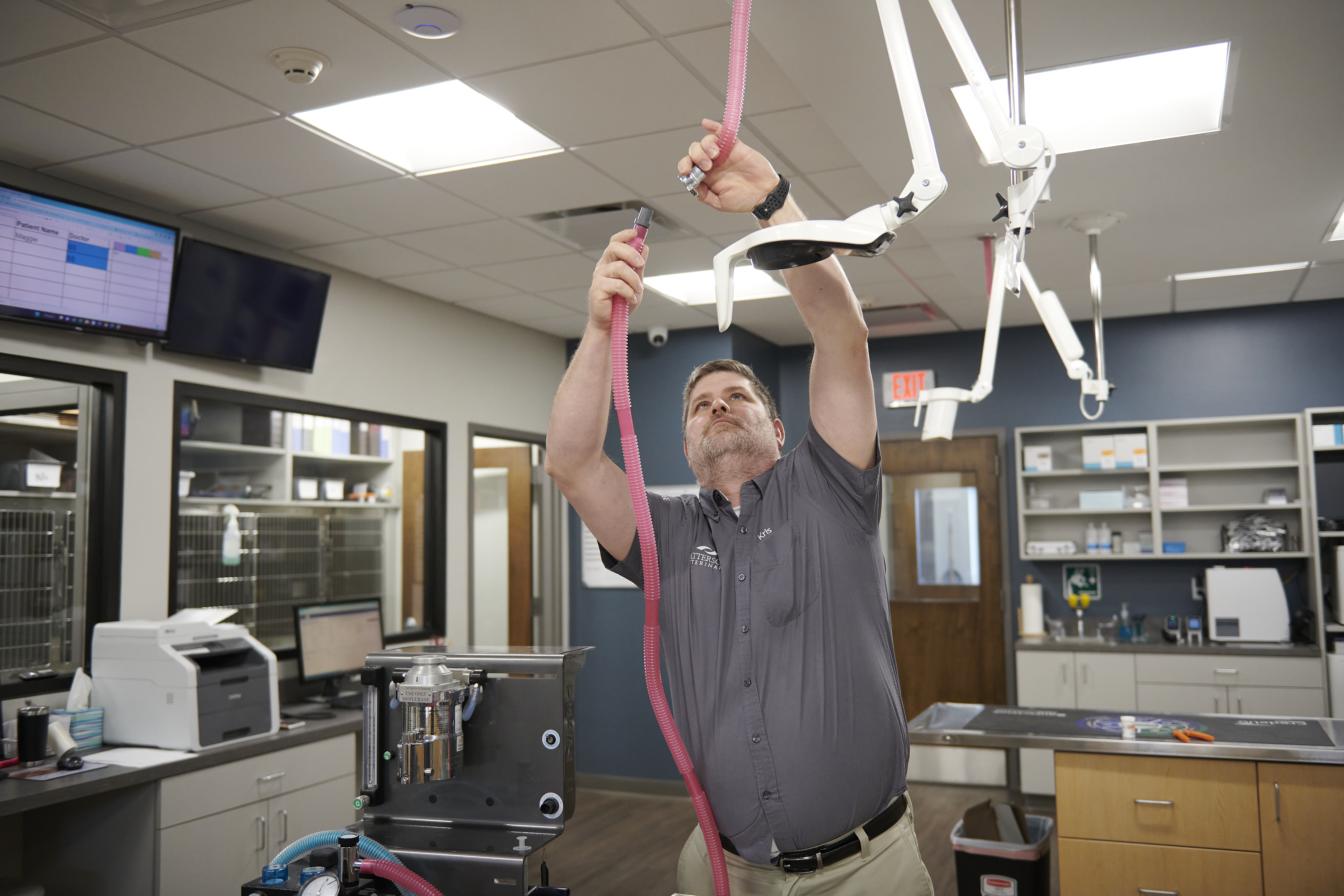

Tax professional Regina Rennhack shares key tax planning principles for veterinary practices, including why making equipment purchases to generate depreciation-related tax benefits may be worth exploring, and the ways this decision can impact your business’s financial health.