It doesn’t matter whether a business has had a bad year, a great year, or somewhere in between; there are valuable opportunities that may be missed if you don’t connect with a professional.

One of the first tax planning principles practices may consider is making equipment purchases to generate depreciation-related tax benefits. While purchasing equipment solely for the purpose of generating income tax deductions is never advisable, most year-end planning discussions explore it.

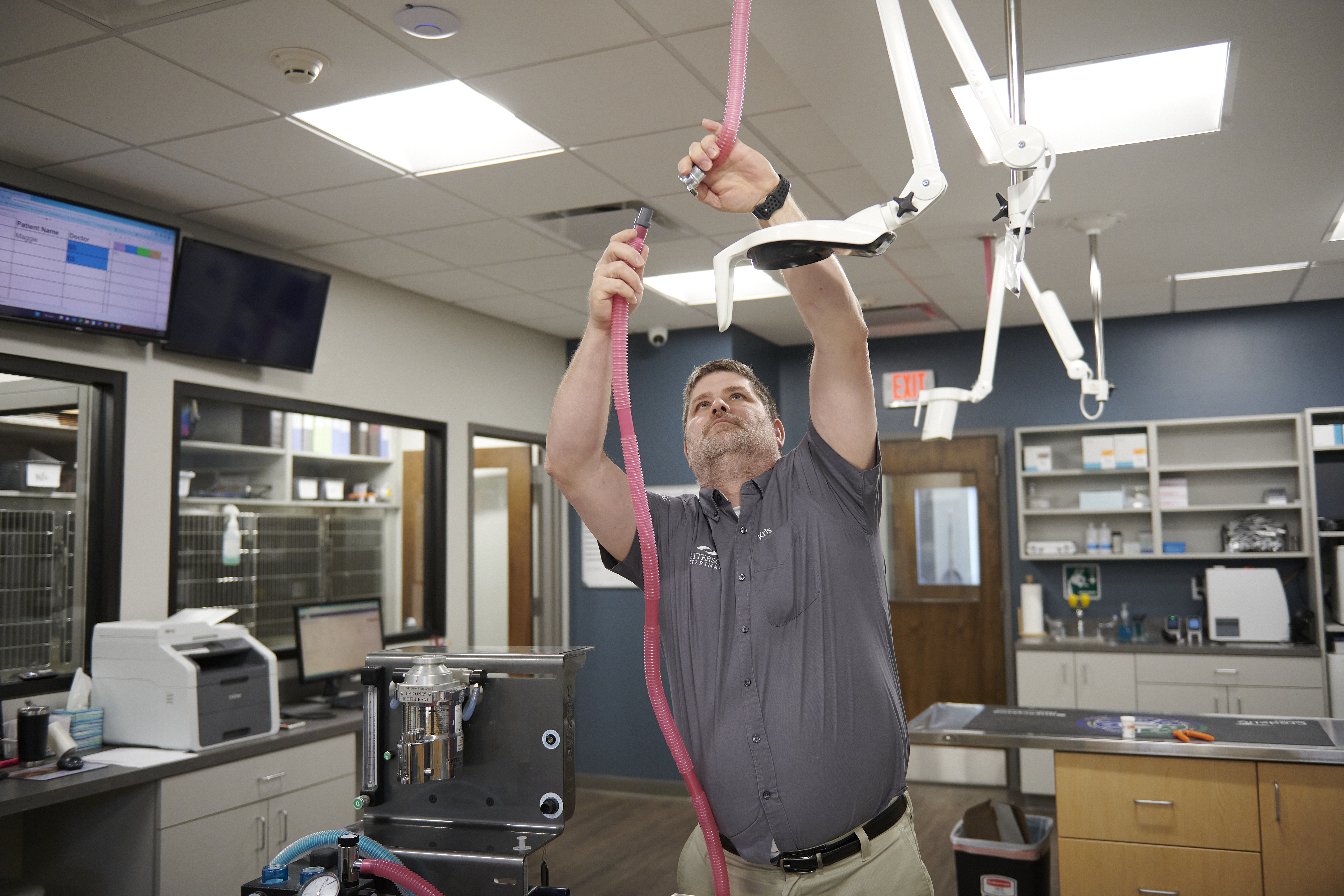

The reason they do this is simple: regardless of when it’s purchased, new equipment can generate additional revenue, improve efficiency, save on repair costs and provide needed tax relief through depreciation deductions. If you choose to purchase new equipment in the fourth quarter of the year, here are some things to keep in mind regarding how it may impact your business’s financial health.

Depreciation deduction basics

How are depreciation calculations considered and what choices do practices have when it comes to calculating them? In short, it’s all about the tax code and it isn’t always simple.

Depreciation choices are elections regarding the timing of the deduction, not the amount of the deduction. Most medical equipment used in veterinary hospitals is depreciated over five years. In addition to the normal depreciation, the tax code provides for additional expense options using bonus depreciation and Section 179 expensing, which are two options for consideration to accelerate the amount of deduction that is available for the first year the asset is placed in service.

If you’re going to consider depreciation as a factor in tax planning, there’s one big thing to keep sight of: equipment must be “placed in service” by December 31 of a year to be eligible for deprecation for that same year. Many people think that as long as it’s paid for, or in the building at that time, they’re covered. But this simply isn’t the case.

With this in mind, it makes sense to shop for equipment earlier in the quarter, so you have time to make the best selection, get it on board, and get it working for you. Keep in mind, you can also take advantage of sales or finance specials to make this purchase easier.

Bonus depreciation and Section 179 election

If depreciation considerations are going to play a role in your tax planning, there are other things you and your advisor will likely consider. The first is bonus depreciation, a tax incentive that allows a business to immediately deduct a percentage of the cost of qualified new or used assets in the year purchased and placed in service.

Qualified property that’s eligible for bonus depreciation has a useful life of 20 years or less. From 2017-2022, bonus depreciation has been 100% depreciation in the year placed in service. In 2023 it was reduced to 80% and for 2024, bonus depreciation is now 60% of the cost of the asset with the remaining 40% depreciated over the useful life. If there aren’t further changes to the current tax law, bonus depreciation will continue to decrease to 40% in 2025 and 20% in 2026.

The second option to consider is electing Section 179, which allows an immediate deduction of a variable amount up to a 100% write-off of the cost of the asset in the year placed in service. Another thing to keep in mind is that Section 179 requires a business to have a profit to be eligible for the deduction. In comparison, bonus depreciation can be taken even if the practice has a loss for the year. If Section 179 is elected, and the amount exceeds the overall profit for the year, the excess is carried over to the next year to be utilized against future profit.

Depreciation options are not one-size-fits-all

Currently, in 2024 and beyond, practice owners can still achieve an immediate 100% write-off for their fixed assets purchased during the year. This can be done by either combining bonus depreciation and Section 179 deductions or simply electing Section 179 on all asset purchases. The advantage lies in having options available, as sometimes we only want a portion of the deduction in the current year.

It's also important for businesses to know state rules for the amount of depreciation allowed. Many states have elected to not follow the federal law when it comes to bonus depreciation and Section 179. If their state does not follow the federal depreciation rules, a practice might choose a different strategy when it comes to state depreciation. Balancing the federal and state deductions is normally done at tax preparation by running different scenarios to determine the most tax-efficient strategy.

In the end, tax planning isn’t a one-size-fits-all proposition. There’s no substitute for a plan that considers a specific practice and personal circumstances. A qualified tax professional with small business and even veterinary practice experience can help owners run their business as efficiently as possible.

Share

Related blogs

Year-End Tax Considerations for Vet Practices: Part 2

Planning your practice's taxes as much as three months before the end of the year can help you make choices that get the next year off to a strong start. Tax professional Regina Rennhack is back with part two of her series, sharing even more key tax planning principles for veterinary practices.